Over the last two decades, Spokane Neighborhood Action Partners (SNAP) has supported the growth and advancement of Spokane’s small-business culture. A subsidiary, Snap Financial Access, provides housing counseling, business development services, finance training, and loans. It founded Spokane’s chapter of the Women’s Business Center, Inland Northwest (WBC). Funded partly by U.S. Small Business Administration grants, the Women’s Business Center is entering its 11th year in Spokane. Dedicated to supporting aspiring and existing entrepreneurs to start or scale their businesses, they not only serve women but minorities and veterans as well.

“The WBC is all about supporting small business growth, building assets and creating wealth,” said Nicolle Hansen, Manager of the WBC in Spokane, “We’re providing necessary resources to underserved and underrepresented communities, focusing on economically or socially underserved patrons. Our goal is to provide the information and tools people need to make their own [personal and business] decisions.”

History and Legislation of the Women’s Business Center

At the federal level, the WBC Program started in 1988 with the passage of the Women’s Business Ownership Act, giving female entrepreneurs the first opportunity in history to apply for loans without a male co-signer. The same legislation formed the WBC programs and National Women’s Business Council, “a non-partisan advisory board that presents issues to the President and Congress regarding women’s issues,” stated Hansen.

There are currently 146 WBCs across the country, and up until last year, not every state had one. Funding for WBCs has remained static, with a 100% match requirement needing to be met yearly. Local investment is crucial to the program’s success. SFA appreciates local support from credit unions, banks, and foundations but must reapply for funding annually.

The WBC was initially created to help women access small-business financing because financial assistance and freedom often go hand-in-hand. In the last two years, 157 jobs have been created or retained by Spokane businesses supported by the WBC, and the program is on target to serve nearly 400 individuals looking for business assistance this year.

Women and Minorities Face Challenges in Business

“It’s important to learn about the issues women, minorities and veterans face in starting a business. 1988 was not long ago,” says Hansen. “To this day, women don’t receive the same funding male-driven businesses receive.” Similar circumstances exist for minority populations. “Bringing support to underserved and underrepresented community members is important.”

“Frequently, women juggle caring for their families with earning money to support their needs,” says Hansen. “This presents a unique challenge.” Some inherent difficulties lie in our system’s structure, making it hard for women to access services. “With children, it’s harder to make time for advising,” she adds. “We’re specifically interested in helping women-led businesses that support other women as well, such as daycares, medical, and coaching fields.”

Services and Offerings for Spokane’s Women in Business

The WBC’s principal specialty is helping individuals plan, prepare and apply for loans to fund their businesses. They provide premium training, coaching and workshops, both online and in-person, to help clients identify gaps in their knowledge or experience.

“Regardless of what line of business you go into, there are some basic similarities,” says Hansen. No matter the occupation, writing business plans, having knowledge of hiring, and financial projections are necessary steps in starting up. There’s the “creative side of business and the management side. Entrepreneurs need both.” Working with clients to hone in on their skills and expertise, the WBC helps with organizing, outlining and business planning—through all stages of the process.

“Our goal is to provide the information and tools people need to make their own decisions. We start with a business plan, cash flow projections, and financials,” said Hansen, “What’s the feasibility of their business idea? How would a loan impact their business? Are changes needed in their proposed business model? Potential challenges need to be identified to create solutions and solve problems.”

Working to connect clients to the best information possible, the WBC also refers customers to outside workshops and partnering organizations. They greatly “benefit the Spokane community by having a huge network of colleagues—a big [and cooperative] business ecosystem. If we don’t know how to do something, we have other resources to send people toward,” noted Hansen.

Financing Opportunities For Women in Business

SNAP Financial Access, considered a microlender, is a Community Development Financial Institution providing loans from $500 to $250,000 for Spokanites and Eastern Washington.

In an average year, the Spokane WBC has reinforced the start of 50 businesses. In the past two years, their clients have acquired over $900,000 per year in loan capital for both new businesses and existing businesses looking to grow their current operations.

Hansen mentioned that although attaining grant funding is possible, “Grants are difficult to acquire. A lot of grants we see online are fakes, so be wary when it comes to grants.” However, when an actual grant opportunity arises, the WBC promotes it to clients and the public via social media.

Virtual Business Classes and Networking Events in Spokane

Online technologies like Zoom have made information and resources accessible to people, no matter their schedule or setting. “Our online coaching and training sessions are great because clients can access them from anywhere,” shares Hansen. Recently, rural businesses have been able to flourish. Whether it’s building a home business, an agricultural undertaking, or something in a small town, more and more people have been able to join virtually.

The WBC’s annual Entrepreneurial Summit provides a great networking opportunity, bringing together business owners from all over the area. Training, workshops, speakers, and breakout sessions are available throughout the event. Not wanting to prevent or restrict access due to price, discounted rates are offered for people in certain financial situations. Open to anyone, this networking, training, and capacity-building event will fall on August 23, 2024.

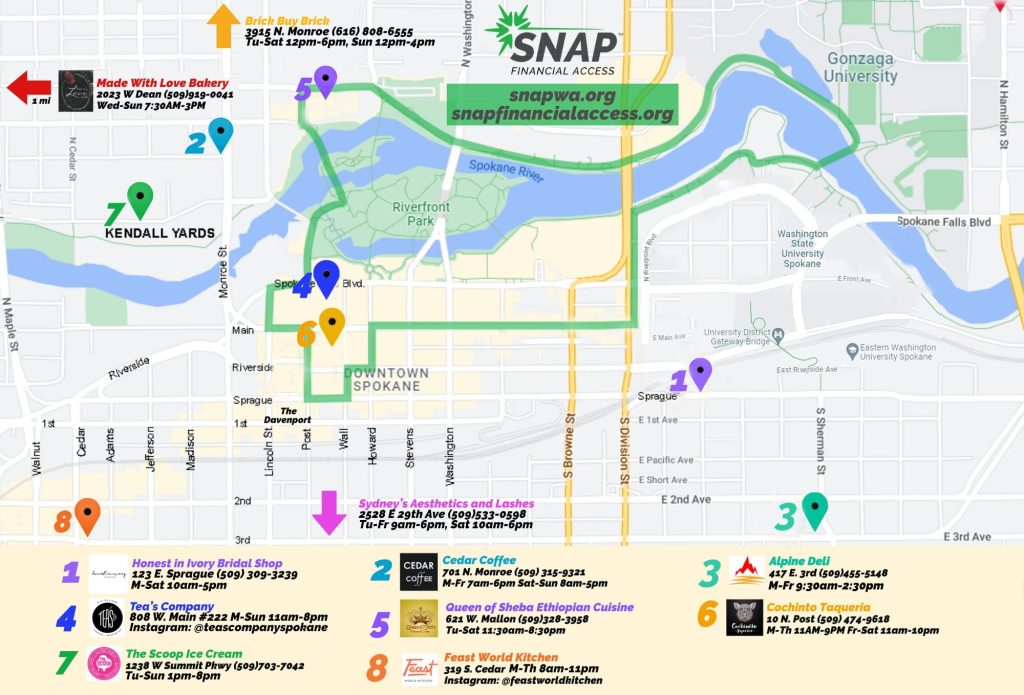

WBC & SNAP can also be found tabling at local events, such as the monthly summer NIGHT MARKET & Street Fair in front of the Catalyst Building every second Friday from May through October. Learn more about their offerings and participate in interactive business activities at the Night Market & Street Fair on June 14 from 5 until 9 p.m.

Resources Aiding Spokane’s Female-Led Businesses

At the WBC, time spent with patrons varies based on personal and business needs. Some clients are short-term, attending only a few subject-based meetings. Some choose monthly or bi-weekly coaching sessions, and others have been working with the WBC for the past ten years. “It really depends on the stage of business planning [or scaling] process,” says Hansen.

The Small Business Administration (SBA), Washington Small Business Development Center (SBDC), and Service Corps of Retired Executives (SCORE) are some great resources for Spokane’s small businesses, startups, entrepreneurs and students. Spokane Library, the local Chamber of Commerce, and Washington State Microenterprise Association’s Evergreen BizLink provide great small-business-related resources and classes as well.

Starting Your Own Business in Spokane

In terms of advice for aspiring entrepreneurs, Hansen encouraged, “Find a mentor! Somebody you can go to that you trust and talk about your ideas.” Running your own business is no simple task, and it can get lonely if you’re trying to navigate everything independently. A mentor who believes in you will motivate you, hold you accountable for your success, and give you a sense of community and collaboration. “Coaches and mentors make a world of difference,” Hansen adds. Without them, it’s harder to get things done. They can push you when you need it, hold you up when you need a boost, and help keep you engaged and moving forward.”

“When you’re a small business owner, you’ll never live the same day twice,” shares Hansen. “There are always different challenges, and it’s okay if things aren’t going perfectly. You always have the chance to rebrand, reinvent, and pivot your business. Keep an open mind to possibilities, changes, and opportunities. Starting a business can be scary, but it’s inspiring!”

Last year, the WBC’s “Washington State Entrepreneur of the Year” was Cassie Clearly of Honest in Ivory. Another standout business, Adorkable Flowers & Gifts by Andrea Walgren, is a ten-year staple in the community.

Hopeful Future for Female Entrepreneurs

“I have seen so many people overcome immense personal and financial struggles to follow their dreams,” shares Hansen. Starting with clients when they are most vulnerable, some not having access to housing or food, “We want to help stabilize them. [When people] have basic financial education, they can get a job, then buy a home, then have more opportunities for dreams to be fulfilled. ‘Now I have a home, I want to start a business, or now I have a business, I want to buy a home.’”

People can use their skills, knowledge and expertise to create their own future. “Be steadfast in your desires to improve your life [and soon you’re] making a difference and providing for your family,” says Hansen. Eventually, you will get to the point where you’re “impacting the community by providing jobs for other people. It’s not just about one person, but your impact on others as well.”

“Women are very collaborative and tend to create meaningful connections to support and grow their business. I’ve laughed with my clients, I’ve cried with my clients, I’ve celebrated with clients. They do the hard work, and I’m just here to provide them with a little bit of support and answers that point them in the right direction.”

Ready for business coaching, resources, training and access to potential capital? Spokane’s WBC is ready to lend a hand. Get started by gaining the tools and skills you need to start your business with Spokane’s Women’s Business Center.